January 18, 2016 - Calpensions

State plan for automatic IRA may surface soon

A new state board, Secure Choice, is looking at two options for a plan that would require most employers to offer workers the option of an “automatic IRA,” a payroll deduction for a tax-deferred retirement savings plan.

One option has no protection against investment losses, unless expensively insured. The other has a reserve, built with peak earnings in good investment years, that could over time be used to reduce losses in bad years.

After 2 years of work, crunch time is here. Last week, the nine-member Secure Choice board scheduled a meeting on March 23 to pick the retirement savings plan that will be sent to the Legislature for approval.

It’s part of a national trend among states to attempt to supplement federal Social Security as average life spans lengthen, health care costs grow, and an annual survey finds only a fifth of workers expect to have enough money to retire comfortably.

More than half of the states have legislation that could implement (five states), study (18), or has considered (four) retirement savings plans, according to the Georgetown University Center for Retirement Initiatives.

In an important boost, the Obama administration’s labor department, as urged by California and other states, issued guidelines last fall exempting state-sponsored savings plans from a federal pension law (ERISA) that imposes burdens on employers.

California was an early leader in the trend when Senate President Pro Tempore Kevin de Leon, D-Los Angeles, introduced legislation in 2008 for a state-sponsored savings plan while he was still in the Senate.

De Leon finally obtained legislation (SB 1234 in 2012), despite opposition from business groups worried about another employer burden, taxpayer groups fearing more pension-like debt, and Republicans who prefer private-sector solutions.

But approval only only came after he agreed to a heavy lift: a legal and market analysis not paid for by the state, approval for IRA-like tax treatment, exemption from ERISA, a self-sustaining plan, and final legislative approval giving opponents another chance to block it.

Meanwhile, other states are moving faster. California was not the model in New Jersey last week as the Legislature clashed with Gov. Chris Christie, one of the Republicans running for president this year.

A Democratic proposal for a state-sponsored retirement plan similar to a payroll-deduction in Illinois, which is expected to start enrollment next year, was approved by the New Jersey Legislature with the backing of AARP, a powerful retirement group.

Christie vetoed the plan, saying it would burden small businesses and duplicate private-sector plans. Then the Legislature approved his proposal for a marketplace, similar to one in Washington state, where small employers can shop for retirement plans.

Another sign of the national trend was a report issued last week by the Pew National Trusts: “Who’s in, Who’s out: A Look at Employer-Based Retirement Plans and Participation in the States.”

In California access to and participation in a job-based retirement plan are both below the national average among states, the Pew report found, an echo of the data on the Secure Choice website in the office of state Treasurer John Chiang.

About 6.3 million California private-sector workers do not have an employer that sponsors an retirement plan, said the Secure Choice website, nearly two-thirds of them people of color.

“Nearly half (47 percent) of California workers ・public and private ・are currently on track to retire with incomes below 200 percent of federal poverty level (i.e., about $22,000 a year),” said the website.

A payroll deduction is said to be a proven way to increase retirement savings. A decision to set money aside to invest for retirement is made only once, not repeatedly amid daily budget pressures as paychecks arrive.

Under Secure Choice, workers with employers that have five or more employees, but offer no retirement plan, would be automatically enrolled in the new state savings plan, unless they opt out.

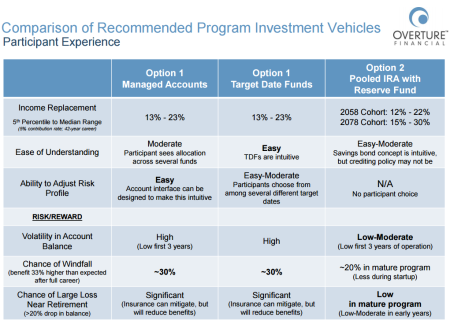

One of the plan options being considered by the Secure Choice board is like an IRA with no loss protection. The board would have to make a decision about the type of investment funds and whether they would be insured to provide loss protection.

The other option is an innovative pooled IRA that gives the employee something like a variable-rate savings bond. But it has a reserve fund, built up over time by taking some of the peak investment returns, that could be used to offset investment losses.

The Secure Choice board, depending on annual investment returns, would decide how much to credit the savings bond and whether to dip into the reserve. Models project the reserve could reach 40 percent of the total trust fund in 20 to 25 years.

That’s said to be large enough to offset an investment loss like the one in the recent financial crisis. Some think this option would have potential problems with generational equity, liability for board decisions, and pressure to spend large reserves.

But without using taxpayer money, the pooled IRA may be nearest De Leon’s original vision of a “cash balance” plan that provides a guaranteed minimum return, like the California State Teachers Retirement System’s Defined Benefit Supplement.

Secure Choice raised $1 million in donations, half from the Laura and John Foundation, to hire Overture Financial for a market analysis and K&L Gates for legal analysis.

Last week, the Secure Choice board increased the $498,366 Overture contract by $25,000, mainly for travel from its New York office, and the $275,000 K&L Gates contract by $80,000 to pursue a precautionary SEC exemption from securities law.

The final Overture report, which will not recommend a plan option, is expected to be delivered by the end of this month. After public display during February, hearings on the report are scheduled in Los Angeles on March 1 and in Oakland on March 3.

Then the board staff, acting Secure Choice director Christina Elliot and David Morse of K&L Gates, are expected to use public input from the hearings and the Overture report to make a plan recommendation to the board for action on March 23.

Whether De Leon prefers one of the plan options being considered by the board, or an alternative, was an unanswered question last week. Legislation approving a Secure Choice plan would create a new state program touching millions.

It could begin modestly, then evolve over time.